The Bitcoin Time Bomb: Why the Real “Last Bitcoin” Deadline is Closer Than You Think

When you first dive into Bitcoin, one of the most compelling facts you learn is its absolute scarcity: only 21 million Bitcoins will ever exist. You’ve probably also heard the magical year “2140” thrown around as the date the last Bitcoin will be mined.

But here’s a little secret that often gets lost in translation: for all practical purposes, the Bitcoin mining era will be largely over around 2040 – a full century earlier than you might expect.

Mind blown? Let’s break down why this often-cited “2140” date is technically correct but practically misleading, and what it truly means for the future of Bitcoin’s supply and security.

Understanding Bitcoin’s Halving Schedule

To grasp this, you need to understand Bitcoin’s ingenious “halving” mechanism. Roughly every four years (or every 210,000 blocks), the reward that miners receive for validating transactions and adding new blocks to the blockchain is cut in half.

- 2009: Miners earned 50 BTC per block.

- 2012: Halved to 25 BTC per block.

- 2016: Halved to 12.5 BTC per block.

- 2020: Halved to 6.25 BTC per block.

- Next Halving (Estimated 2024): Will halve to 3.125 BTC per block.

This process continues until the block reward becomes so tiny it practically rounds to zero.

The Myth vs. The Reality

The 2140 date refers to the mathematical point at which the block reward, after successive halvings, will effectively hit zero. At this exact moment, the very last satoshi (the smallest unit of Bitcoin, 0.00000001 BTC) will have been mined, and the total supply will have reached its cap of 21 million.

However, the reality is far more nuanced.

Why 2040 is the More Realistic Benchmark

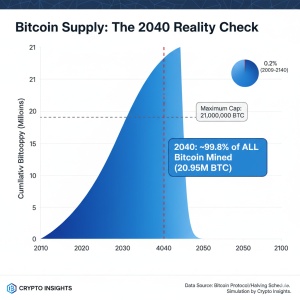

Consider this: by the year 2040, an astonishing 99.8% of all 21 million Bitcoins will have already been mined and be in circulation.

Think about that. In just under two decades from now, virtually every Bitcoin that will ever exist will have been introduced into the market. The remaining 0.2% will be dribbled out in increasingly minuscule amounts over the next 100 years, making their impact on the total supply negligible.

Here’s what that looks like in simple terms:

- Today: Around 19.5 million BTC out of 21 million (approx. 92.8%) are in circulation.

- By 2040: Over 20.95 million BTC will be in circulation. The block reward will be incredibly small, and the amount of “new” Bitcoin being introduced will be almost imperceptible.

This chart illustrates how the vast majority of Bitcoin enters circulation in the earlier years:

What Does This Mean for Bitcoin’s Future?

This distinction isn’t just a technicality; it has significant implications:

- Extreme Scarcity Sooner: The “digital gold” narrative strengthens dramatically. The market will grapple with an almost entirely fixed supply much sooner than many realize. This could intensify supply shocks and potentially increase volatility if demand rises.

- Miner Incentives Shift: Once new Bitcoin rewards are negligible, miners will rely almost entirely on transaction fees to secure the network. This means the fee market will become crucial for Bitcoin’s long-term security model. It also incentivizes efficient network usage and potentially the growth of Layer 2 solutions like the Lightning Network, which can help scale transaction capacity.

- Inflation Rate Drops to Zero (Effectively): The inflation rate of Bitcoin, which is currently around 1.7% (post-2020 halving), will continue to fall with each halving until it effectively hits zero by 2040. This makes it a truly deflationary asset in practice, contrasting sharply with fiat currencies that can be printed indefinitely.

The Takeaway

While the year 2140 marks the absolute theoretical end of new Bitcoin creation, the reality is that the vast majority of Bitcoin will be in circulation by 2040. This makes Bitcoin’s scarcity an even more immediate and impactful factor in its economic model.

Understanding this nuance isn’t just a fun fact; it’s key to appreciating the brilliant, pre-programmed monetary policy that makes Bitcoin such a revolutionary asset. It truly is a countdown, and the most significant part of that countdown ends sooner than most people think.

💬 Reach out anytime

Have comments, post ideas, discussions, or questions? I’d love to hear from you.

Email: contact@inbox27.com